3 minutes

UTMA Accounts for Children

Investing in Your Child’s Future: The Power of UTMA Accounts

In the quest to secure a bright financial future for our children, numerous tools and options are available. One powerful yet often overlooked instrument is the Uniform Transfers to Minors Act (UTMA) account. An UTMA account is more than just a saving or investment account; it’s a long-term financial planning tool designed to help secure a child’s future.

So, why is an UTMA account an exceptional investment gift for your child? Let’s delve into its primary benefits.

The Return

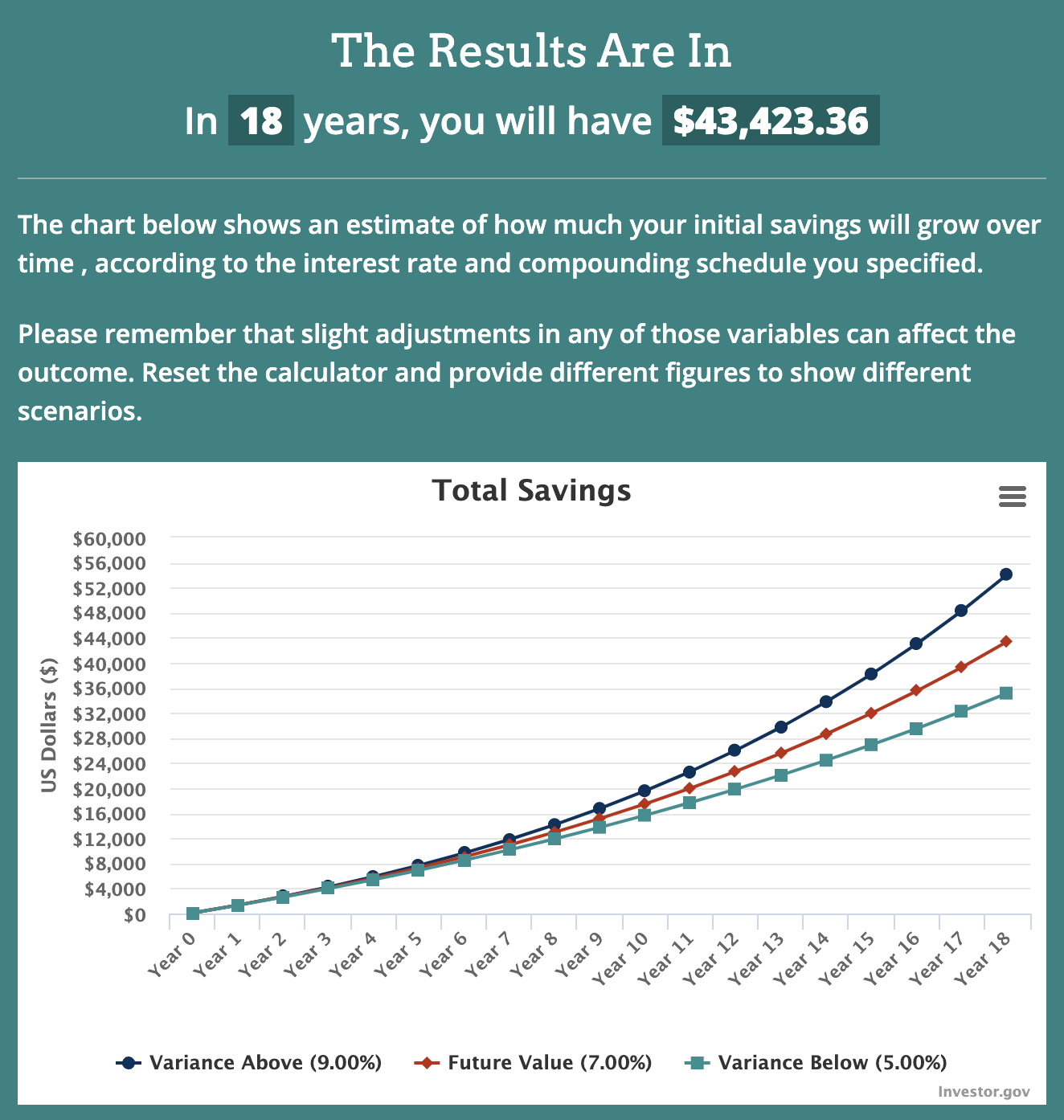

This is $100 dollars compounded monthly into a low risk dividend ETF with continuous reinvestment.

Ease of Use

You can setup a UTMA account for your children in a few minutes on an investment site like Fidelity. The approval process may take 48 hours, and then you can start giving and investing for your childs future.

Versatility

Unlike other custodial accounts such as the Uniform Gifts to Minors Act (UGMA) accounts, which are restricted to holding cash, stocks, bonds, and similar types of assets, UTMA accounts can accommodate a wider array of assets. They can hold any form of property, including real estate, fine art, and even patents. This flexibility allows parents or guardians to build a diversified portfolio for their child’s future.

Tax Advantages

From a tax perspective, UTMA accounts can be attractive. The first $1,000 of the account’s income is tax-free, and the next $1,000 is taxed at the child’s rate, which is typically lower than the parents’ rate. This structure can lead to significant tax savings over time, maximizing the growth potential of the assets held within the account.

Anyone can contribute up to $17,000 per child each year free (2023) of gift-tax consequences ($34,000 for married couples). This helps set a child up for a secure future without a tax burden.

Long-term Growth

When considering any investment, potential for growth is a key determinant. Given the time horizon associated with UTMA accounts—these funds become accessible when the child reaches the age of majority, typically 18 or 21—the power of compounding can significantly boost the value of the assets within the account. This long-term growth potential is a critical component in preparing for future expenses such as college tuition or a down payment on a first home.

Financial Education

Beyond the financial benefits, an UTMA account is a practical tool for teaching children about investing and financial management. As your child matures, involving them in decisions about the account’s assets can provide invaluable lessons about investing, risk management, and the importance of long-term financial planning.

Lifetime Gift

The funds within an UTMA account irrevocably belong to the child, making it a true financial gift. When they reach legal age, they gain full control over the account. By this point, the gift you’ve given has the potential to significantly impact their financial independence and stability.

Conclusion

UTMA accounts offer a combination of flexibility, tax advantages, long-term growth, and financial education that make them a potent tool for investing in your child’s future. Remember, the best investment we can make is in the future of our children. An UTMA account is a unique and effective way to do just that.